Is A Million Dollars A Lot In This Age? Breaking Down Wealth in Today's World

It’s a question many of us have pondered: Is a million dollars still a big deal? While it may sound like a fortune, the reality depends on where you live, your lifestyle, and the current state of the economy.

Who wants to be a millionaire anyways?

We all should, in fact, need to be.

According to a 2022 survey, 9% of American households have saved at least $500,000 for retirement. Only 3.1% of Americans have $1M saved.

No wonder we have looming social security issues on the horizon.

With inflation and rising costs, that million-dollar milestone isn’t what it used to be! Previous generations prior to millennials could afford to live a comfortable lifestyle but not for those born in the 1980's on forward.

Personally I am shooting for a range between $5 to $10M by the time I hit my sixties. This might change to a higher amount as I continue to work towards my goals and progress through life.

Let’s dive into what $1M really means in 2024 and whether it can provide the financial freedom we imagine.

The Historical Value of a Million Dollars

Let's compare what $1M could buy 50 years ago versus today in 2025. The purchasing power of $1M in 1975 would be equivalent to about $5.86 million today!

Every year the impact of inflation increases with prices and purchasing power decreases. Typically inflation has historically been between 3 to 4%, with the highest recorded in 1920 at a whopping 23.7%. At various points it has spiked in the lower double digits but these periods are rare for the most part.

Essentially, this results in diminishing the milestone of reaching the “millionaire” status over the decades.

Let's take a step back though and observe that just because it's been diminished that it is not an impressive and crucial milestone.

It is simply no longer the end goal.

A Million Dollars and Lifestyle Expectations

We've also got to consider what $1M covers in different areas. Obviously it's not going to stretch as far in New York City as it does in a small town in Oklahoma.

Where you live during your financially free years, and possibly relocating to a less costly area such as out of state or overseas, is certainly a common topic to be considered. Every day people make decisions to move within the U.S. from areas with state taxes to those that don't have any or with lower cost of living.

The biggest expense categories to be considered are housing, education, and healthcare costs because they can take up the majority of lifestyle needs. In 2024, the average house in the United States was about $419,200. Just 10 years prior the average was just below $350k.

Healthcare typically has a higher long-term inflation rate of the overall economy with an average of 5.11%. Prescriptions, operations, or even the insurance premiums themselves can take a heavy toll on a nest egg.

Typically when it comes to retirement planning a rule of 4% has been the standard. Basically, you determine how much income you can withdraw by taking your total nest egg that you've built up for retirement and multiply it by 4%.

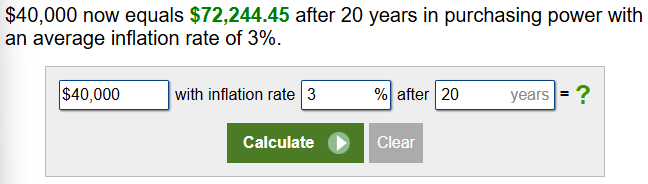

So let's say for a portfolio that has $1M balance this would be $40k a year ($1,000,000 x 4% = $40,000).

Now knowing this, you can ask yourself the question: Can you comfortably retire on $1M?

The answer is if you are currently retired as you read this, and are debt free living a simple lifestyle, you probably can.

In fact, the median retirement income in the United States as of 2025 ranges between $28,000 to $55,000. So living off a million is definitely doable in today's dollars depending on where you choose to live.

For most of us with a few decades until we reach retirement age it's probably out of the question. Being a millionaire is no longer going to cut it. You must set your sights on becoming a multi-millionaire.

Inflation and the Shrinking Value of Money

Now consider the impact of inflation on savings and investments. If your money is sitting idle in a savings account earning nothing then you are actually LOSING money each year with a negative rate of return.

Think about it, if inflation is 3% and you're money is earning next to nothing in your savings account then you are left with a -3% return. Another reason to look into storing your emergency money in a high-yield savings account.

Think of inflation as financial erosion. You won't even feel it until it's too late and your dollar doesn't stretch as far as it used to.

Using the example from above of living off of $40,000. If we assume an inflation rate of 3%, then in 20 years it will take about $72,000 to equal the same buying power today!

Combating the effects of inflation is the primary purpose of investing. At the very least you want your dollars to keep pace with inflation and retain it's purchasing power with increasing prices.

If you're shooting for an average rate of return annually of 8%, and inflation is 3%, then your real rate of return is 5%.

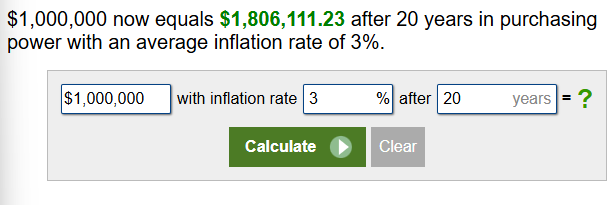

Now let's consider how rising costs erode the value of $1M.

So realistically, to have the same buying power of $1M today we will have to accumulate about $1.8M if your time horizon to be retired is in about 20 years. This target is what most of the general population needs to be working towards.

Is $1M Enough for Financial Freedom?

Does $1M achieve financial freedom? If you're planning on drawing 3-4%, then $30-40k is hardly enough to be considered financially free even in today's dollars.

Remember that financial freedom means that your desired lifestyle is fully covered by your passive investment income.

For most people, a million may sound like a big number but wouldn't even be enough to even be considered financially secure when stretching it out over decades. Financial security means that basic living expenses are covered such as housing, food, and bills.

If you're really frugal then you might be able to be financially secure today but will certainly lose that security year after year as inflation takes its toll.

Now and into the future you'll need to focus on building skills in balancing income, expenses, and savings. Good money management goes a long way.

Strategies to Maximize the Value of $1M

Considering all of this it's no wonder that making smart investments to protect and grow our wealth is an absolute priority.

When it comes to investing we talk about diversification by means of asset allocation but we also need to keep in mind that we should also be diversifying our income streams.

The average millionaire has 7 sources of income. These streams include:

- Earned income

- Dividend income

- Rental income

- Business profits

- Interest income

- Capital gains

- Royalty income

The same concept of not having all of your eggs in one basket applies to where you income comes from. Having multiple sources of income can help people weather the ups and downs of any industry.

Building up multiple streams of income can take years or even decades. However, some income streams, like dividend income from stocks, are accessible to the average person.

At the current rate of inflation it would be an absolute necessity to adhere to a minimalist lifestyle with daily frugal habits in order to make $1M last a lifetime.

It can be done although it's not going to be the lifestyle fit for everyone.

While a million dollars remains an impressive figure, its actual value depends on a variety of factors like where you live, how you spend, and how you invest.

In 2025, $1M may not guarantee the financial freedom it once did, but with smart planning, it can still unlock a comfortable and secure lifestyle.

Realistically most people still working towards retirement over the next few decades need to be shooting for at least double this amount. Becoming a multi-millionaire may seem out of reach but with the right plan and focus it can be achieved.

What do you think—would a million dollars be enough for your goals?

Member discussion