Compound Interest Explained: How to Grow Your Money Exponentially

Want to know the secret that turned Warren Buffett's initial investment into billions?

Here's a mind-blowing fact: if you invested $10,000 at age 20 with an 8% annual return, you'd have over $217,000 by age 60 - and that's without adding another penny!

Perhaps you've heard the saying, “Compound interest is the eighth wonder of the world, he who understands it, earns it. He who doesn't, pays it”.

Albert Einstein supposedly called it that. I can't confirm the authenticity although I can attest that compound interest has the power to turn small, consistent investments, into massive wealth over time.

I'm constantly amazed by how many people underestimate the power of compound interest. Whether you're saving for retirement, investing in stocks, or just trying to grow your money, understanding compound interest is key to your financial success.

In this guide, we’ll break it all down in simple terms so you can start using compounding to your advantage today!

The Basic Mechanics of Compound Growth

Let me start by breaking down the difference between simple vs. compound interest. Simple interest means that you only only earn interest on the principal amount (a.k.a. initial deposit).

Simple interest is great when we owe money such as personal loans or cars but not when we're trying to build wealth. Compound interest means you'll interest on the principal amount AND you'll also earn interest on the interest.

Let's break this down with a quick example. You deposit $1,000 at a 5% interest. At the end of the first year you'll have $1,050. In the second year, you'll have $1,102 because now you're earning 5% on $1,050 instead of $1,000.

This is how compound interest accelerates wealth building. You're only going to be able to earn so much throughout your working career. Therefore you'll only be able to set aside a portion of those earnings during that time.

You need help with the heavy lifting. Your money is literally making money and that's super cool!

Now let's get an understanding of what an Annual Percentage Yield (APY) is. APY is the interest rate earned on an account over a year, including compound interest. The more often interest compounds, the greater effect on APY.

APY helps you compare interest rates across different accounts and institutions. A higher APY means you'll earn more interest on your money over time.

The Rule of 72 is one the most underrated tools out there for investment planning. It's super handy, simple, and gives you a quick answer of how long it would take for your money to double at a given interest rate.

For instance, you may be considering an index fund that produces an average 10% return. If things remained consistent with performance then it would take 7.2 years to double your money.

See, it can help you make quick assessments of different options so you can make smarter choices. A really handy tool to say the least.

The Power of Time: Why Starting Early Matters

So we've established that compound interest is great and all but there's one really important disclosure that must be made. The secret ingredient is time.

You see, without time, you won't get the snowball effect of compounding over decades.

For instance, imagine you were planning on investing $10,000. The difference of letting your money compound over 10 vs 20 years can be staggering. In 10 years, assuming a 5% APY, you'll have $16,288 in your account. Let it ride 20 years at the same rate and you'll have $26,532.

That's means you would have 63% more in your account just by having more time!

That's a difference of $1,000 per year that didn't require you to contribute another dime! Now imagine what an impact it would make if you were making regular contributions over that time.

Case study: Investing $100/month at age 20 vs. age 40

If you were to start investing at age 20 with as little as $100/month earning 5%, and didn't stop until you were 65, you would have $202,643 in your investment account. If you did the same thing but didn't start until you were 40 then you would only have $59,550.

Of that $202k you only actually made deposits of $54k total. The other scenario you had to put in $30k to only have it grow to $59k. That's a serious difference when your money is working for you!

This is what we call the cost of waiting which is how delaying investments impacts future wealth.

Where to Find Compound Interest Opportunities

1. Saving & Investing

Just because you're keeping your emergency funds in cash doesn't mean you need to settle for a next to nothing savings account rate.

The core purpose of this money is liquidity although compound interest puts that money to work in a high-yield savings account to earn a rate that at least keeps up with or slightly beats inflation.

I'd rather earn $2k on my $50k with a 4% interest rate instead of .008% in a standard bank account.

Obviously the investment holdings are going to be the primary component of compound returns. This is where it is critical to decide on a set portion of our income to be set aside and put to work and shoot for a reasonable rate of return.

By using compound growth in stocks, bonds, and index funds we can supercharge our portfolio performance if managed correctly.

I stress the words "managed correctly" because it's not always set and forget. This is where dividend reinvestment strategies come into play. As you earn income, in the form of dividends, this money will begin to accumulate and be held in cash within your investment accounts.

If you're invested in funds you can choose to have these dividends automatically reinvested. This means that you'll be purchasing more shares of that fund with this extra money. This is beautiful scenario because now you're investing your money to buy shares and the earned income is also able to buy more shares for you.

You may not always have this option such as when individual stocks are held so you need to keep an eye and make manual purchases if necessary. This is part of managing your portfolio and setting a routine around monitoring performance.

2. Retirement Accounts

When it comes to 401(k)s and IRAs they benefit from compounding in a slightly different way, enhanced if you will.

The first way is through employer matching. Not all employers provide a match and the amount that they match can vary between individual companies. Although if they do then it's basically a wealth turbo booster.

For every contribution you make the employer will match up to a certain percentage. So if you put in 5% of your income, and your employer matches up to 5%, then it's essentially like you got double the money in your account with no extra work.

The second way that retirement accounts, including both 401(k)s and IRAs, provide further compounding enhancement is through the tax advantages they offer.

These accounts allow your money to grow tax-deferred. This means that if you sell an investment at a gain, or earn dividends, you are not currently taxed. The benefit is that these taxes don't chip away at your investments and therefore allow them to grow to a higher amount than they would if held in a taxable brokerage account.

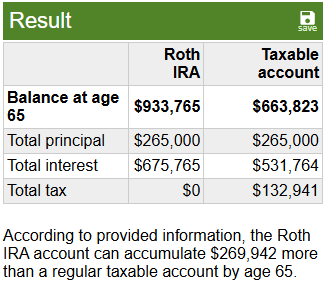

The example above shows the difference in values of making $7,000 contributions to an IRA vs a taxable brokerage account over a 35 year period. This resulted in almost $270k more by simply holding those investments within the tax-advantaged account.

That's MASSIVE difference!

3. Debt & Loans (The Dark Side of Compounding)

Remember that 2nd half of the Albert Einstein quote? "He who doesn't understand compound interest, pays it." That's how credit card debt compounds against you and can keep people digging in the same whole for years.

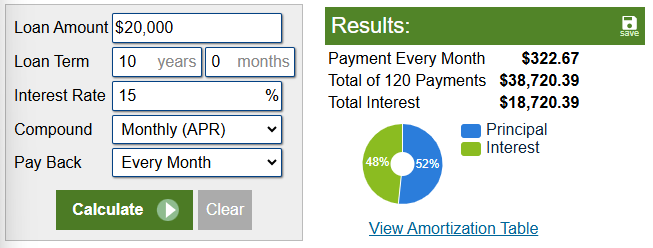

For instance, let's say you had a personal loan of $20,000. If you held this loan to it's full term, in this case 10 years, you'd pay almost as much as you borrowed in interest alone!

Many of these loans are also compounding daily against you, including your mortgage. This is why it is so important, I mean critical, to focus on paying off high-interest loans quickly.

The minimum payment presented by creditors are scams to keep you paying forever. Get a solid debt repayment strategy to quickly eliminate these liabilities from your life.

Maximizing Your Compound Interest Potential

Start early, the time advantage will be your biggest strength.

Make sure you're setting aside a set portion of your income. Regular contributions are a key part of this strategy. Furthermore, let's clear up any confusion or misconceptions.

Small contributions are great for example purposes and demonstrate how compounding works but if you really want to be financially successful, or financially independent for that matter, you're going to need to pony up some capital consistently.

The impact of fees on compound growth isn't discussed enough. Unfortunately this is because it's simply a slow poison and not painful or obvious enough to feel it's effects. That doesn't mean it's damaging effects are any less.

Most fees can be avoided by simply choosing low cost alternatives such as index funds opposed to mutual funds. Also, speaking to you as a former financial advisor, most people don't need to hire a financial advisor when getting started.

What most people need is a system, information, organization, and discipline to put in the effort in order to see results.

If you're paying an advisor 1-2% a year on your seedling investment portfolio I can assure you you're going to end up with a fraction of what you should have when you reach retirement age.

There may come a time when those types of services are of value and needed but 99% of the time not in the beginning. Build the skills first and seek out knowledge...by staying up to date on my new content.

Common Compound Interest Pitfalls to Avoid

So we've covered how powerful compound interest can be and why it's so important to understand if we're going to be successful. Being mindful of this will allow you to make more informed decisions and have a better understanding of the choices you'll face.

Still it's important to detail the most common pitfalls that should be avoided:

- Withdrawing too early

- Impact of high fees on long-term growth

- Missing reinvestment opportunities

- Underestimating inflation effects

- Not leveraging tax-advantaged accounts

Any of these can easily stifle your wealth's true potential.

The power of compound interest isn't just about understanding numbers - it's about taking action. Start harnessing this financial force today, whether you're beginning with $100 or $10,000.

Remember, time is your greatest ally in the compound interest game but you've got to commit. Set up your automatic investments, choose your compound interest vehicles, and let the eighth wonder of the world work its magic on your financial future.

Your wealthy future self will thank you!