Retirement Planning: A 5-Step Guide to Secure Your Future

Retirement planning doesn’t have to be scary—it’s your golden ticket to a fun and worry-free future! Did you know that only about 1 in 3 Americans feel good about their retirement savings?

I’ve talked to so many people getting close to retirement with only a small amount saved. They thought they could just stop working and instantly enjoy a dream life filled with vacations and relaxation. But when they took a closer look, their savings weren’t even enough to cover one year of expenses—let alone 20 or 30 years of comfortable living!

That's a tough conversation to have and a tougher position to be in.

I don’t want that to happen to you. My mission is to help you plan ahead so you can actually enjoy the retirement you deserve!

If you’re not sure where to start, this guide will walk you through five essential steps to take control of your financial future.

From setting goals to building a strong savings strategy, let’s ensure your golden years are as bright as you imagine.

1. Understand Your Retirement Goals

Before figuring out the "how" you've got to figure out the "what" and "why". Assess your ideal retirement lifestyle—travel, hobbies, or simple living. Take a moment to visualize what that looks like.

Do you see yourself living a minimalist, comfortable, or lavish lifestyle? Perhaps you are already living the lifestyle you desire and you want to keep that going for the remainder of your years.

Maybe you have dreams of taking it to the next level. Visualize it and get crystal clear on exactly what you want.

Estimate how much money you’ll need annually to sustain that lifestyle. Are you living within your means right now or stretching yourself into the red zone?

Let's say you earn $100k right now but only actually need $80k to live your desired lifestyle.

Factor in the cost of living and potential healthcare expenses. Maybe you want to pay off your home by the time you hit retirement and be debt free which will greatly reduce your overall income needs.

You may even decide to move to a new area with a completely different cost of living whether it be higher or lower. The sky is the limit in what you can imagine but it needs to be realistic and attainable so you can create an action plan to get there.

2. Calculate Your Retirement Savings Needs

Back in the day as a financial advisor I had access to software that would put together sophisticated investment projections and analysis. I'm here to tell you that you don't need any of that.

If you're willing to nerd out with me for a bit you can put together a solid gameplan by using simple retirement calculators for creating a realistic savings target.

The best thing is that they're FREE!

Let's set the scene for an example so you can understand how to use the calculator yourself.

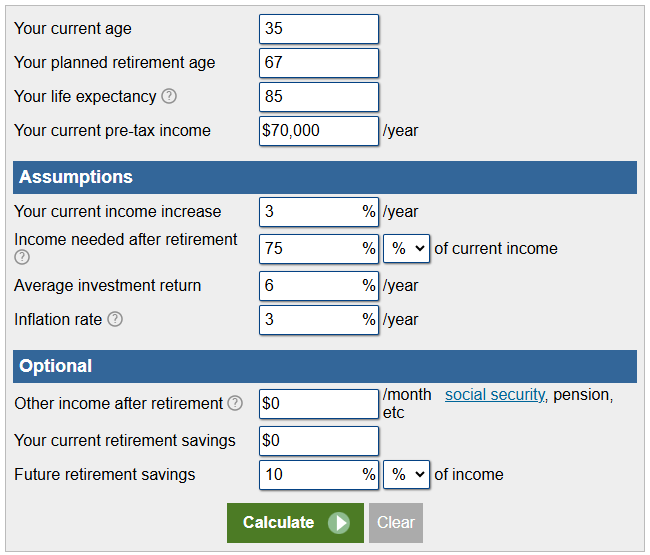

Meet Bob, he's a 35 year old making strides in his career and wants to start planning for his future. He makes $70,000 per year, lives within his means, and is comfortable living off of 75% of that amount when he retires at age 67.

The reason he can maintain a comfortable lifestyle on a lower income is because he plans on being debt free by retirement age and is willing to contribute 10% of his income towards his future goals.

Here are his calculator inputs and following results:

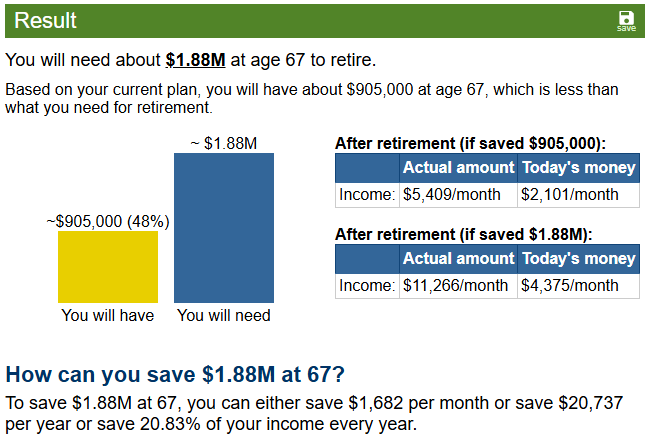

As you can see, Bob fell short by about half of what he needed for his retirement goals. Based on this plan he'll have $905,000 saved up instead of $1.88M. This means that he'll have to make some compromises on his lifestyle in order to make his money stretch for the remainder of his years.

There's a few things to also consider that can affect these results such as other income sources like social security. Another factor could be instead of earning a 6% rate of return on his investments he could adjust for a higher rate of return based on the historical performance of the investments he might be considering.

Remember that historical performance is not a guarantee of future results.

Or he could reach his goal by simply saving more, in this case about 20% of his income, instead of 10% and keep everything else the same.

A great example of applying the 50/30/20 rule that is a good income allocation setup to start with.

Try out the calculator for yourself and play with different numbers to see what you come up with.

Understand the 4% rule for safe withdrawal rates.

Theoretically you should be able to draw this amount over the long term without running out of money. If you want to be more conservative then use 3% as the withdrawal rate.

Let's say you've accumulated $2 million by your desired retirement age. This would mean that you could reasonably draw $60,000 to 80,000 to live off of assuming either a 3 or 4% withdrawal rate respectively.

Consider the impact of inflation and future economic changes. A dollar today doesn't buy what it did 20 years ago and certainly won't buy what it does now in another 20 years.

Be mindful that prices will continue to increase which is a primary reason why we invest in the first place to maintain purchasing power.

3. Build a Strong Savings Plan

It's no secret that the longer you have to invest the greater probability that you will successfully reach your financial targets. Start saving early to take advantage of compound interest.

The best time to plant a tree is 30 years ago, the second best time is now.

Maximize contributions to retirement accounts like 401(k)s and IRAs. These are tax-advantaged investment accounts that can super charge your results from the benefits they offer.

A 401(k) is a employer based retirement account. This means that you can contribute to it only while being an active employee of the company that offers it.

Often times there is a set menu of investment options to choose from and you can have a set portion of your paycheck withheld for the purposes of going directly into the account each pay period.

This way it's out of sight and out of mind and most importantly the automation helps maintain consistent contributions. You'll eventually get used to living off of the remainder.

Your employer may even offer a matching contribution up to amount which is essentially FREE MONEY!

An IRA (Individual Retirement Account) is an account that you can create on your own with many different financial institutions. The difference is that you get to make the selection of the investment holdings which could be index/mutual funds, ETF's, stocks and bonds, opposed to having a set menu of options.

You can also setup automated contributions from your bank account but you will have to make sure and actually place buying trades into the investments because it won't happen automatically like the employer plan.

The last thing you want is to go a year and check your account just to realize that it's been sitting in cash not earning anything.

The benefits of both of these accounts is the tax treatment. Investments grow within your account, accumulating and compounding interest, on a tax-deferred basis.

When it comes time to draw that money out to live off of you can pull out your contributions, plus the accumulated gains, tax-free depending on whether you selected a Roth option or not.

There's a stipulation to getting these tax-benefits though. If you touch this money prior to retirement age you will pay stiff penalties and taxes on the withdrawal which is essentially just blowing your money away in the wind.

Remember the importance of building great savings habits before taking on investing. The United States general population has had a negative savings rate for many years.

The normal scenario is get paid, spend, and possibly save what's left. Automate your savings to stay consistent. Set aside a dedicated percentage of your income to put into your savings and investments.

Build up a properly funded emergency account to handle the occasional obstacles life throws our way.

Here are the primary milestones to shoot for:

- $1,000

- 3 months living expenses

- 6 months living expenses

- 12 months living expenses

4. Diversify Your Investments

Some people view investing as risky or compare it to gambling. Often I find it's because they simply don't understand it and never looked into what a true investment plan looked like.

Not investing and relying on hope is the really risky scenario.

The key behind a solid investment strategy is asset allocation. Most people are more familiar with the term diversification. This means dividing your investment portfolio with stocks, bonds, cash, and index funds. Many of these options are readily accessible to the average person.

Understand the risks and benefits of each investment type and remember to keep a balanced position in your overall portfolio.

Throughout the years of your financial Journey you will need to adjust your investment strategy based on your retirement timeline.

In the beginning you can afford to be more aggressive and growth oriented. As you get closer to approaching your retirement timeline you'll need to switch from a growth strategy to a preservation strategy.

Throughout retirement you'll still want to have a portion of your money invested to at least keep pace with inflation.

5. Prepare for Non-Financial Aspects of Retirement

2020 was a challenging time for the entire world on a level never seen before. There was fear, uncertainty, and doubt along with trying to come to grips on what life would look like going forward.

This was also the first time where people were confined to their homes for an extended period of time. What they chose to do with that time varied greatly upon their personal financial situation and creativity...a lot like what retirement could actually look like later in life.

If you didn't have to go to work each day to earn a paycheck then how would you make use of your day?

Plan how you’ll spend your time whether it be travelling, volunteering, or part-time work. Think of the things that bring you joy and add value to your life. You've spent your working career building up to this point and now it's time to harvest the benefits of all of that effort.

I am a huge believer that your health is truly your wealth. Stay healthy with regular exercise and preventive healthcare. What good would it be to accumulate all that wealth throughout your working years only for it to be spent on pills and procedures.

Continue to stay active and build a social network to maintain emotional well-being.

Don't wait until retirement, find some groups now centered around hobbies and find people with similar interests. Let those relationships grow over decades and keep the good times rolling!

Retirement planning is one of the most important financial steps you’ll take in your lifetime. There will come a time in life that you will stop working simply by ability or willingness.

Being prepared for this time well in advance will make it a smooth transition that you can live out your golden years with peace of mind and confidence.

By following this 5-step guide, you can set yourself up for a fulfilling and secure future.

Start by defining your goals, saving consistently, and making informed decisions about your investments. Don’t wait—your dream retirement starts with the steps you take today.

Member discussion