Top 10 Budget Planners to Help You Save More in 2025

Did you know that people who use budget planners save an average 32% more money than those who don't track their spending? I discovered this the hard way after years of wondering where my money went each month.

Managing your finances doesn't have to be stressful—a budget planner can be a game-changer in helping you track expenses, set savings goals, and stay in control of your money.

Trust me, I've tried everything from hastily scribbled notes to complex spreadsheets, and I can tell you that having the right budget planner makes all the difference in achieving your financial goals.

In 2025, with inflation still on everyone's mind and digital tools becoming more sophisticated, choosing the right budget planner is more important than ever.

Whether you prefer the tactile satisfaction of writing in a paper planner or the convenience of digital tracking, I've tested dozens of options to bring you the absolute best budget planners for every style and need.

Top 10 Budget Planners to Help You Save More

1. Clever Fox Budget Planner – A sleek, organized paper option.

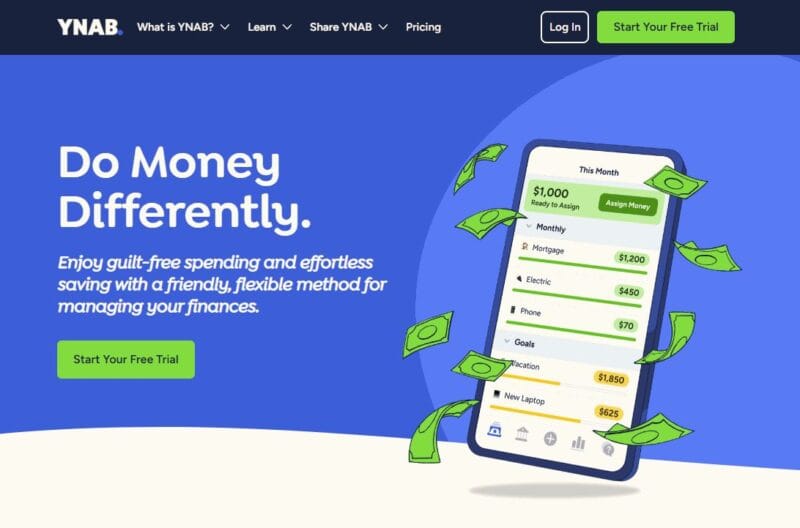

2. YNAB (You Need A Budget) – Best for advanced budgeters.

3. Legend Budget Planner – Expense tracking meets automation.

4. Clever Fox Planner Pro Premium – Stylish, luxurious and functional.

5. Clever Fox Cash Envelopes – Envelope system for cash users.

6. Passionate Penny Pincher Money Planner– Comprehensive goal features.

7. Erin Condren Budget Book – A minimalist's dream.

8. EveryDollar – Zero-based budgeting made simple.

9. Zig Ziglar Performance Planner Plus – Customizable for anything.

10. Simple Excel Budget Spreadsheet – DIY and free.

What to Look for in a Budget Planner

Not all budget planners are created equal and there is no one size fits all. Before choosing one, consider these factors:

Digital vs. Paper: Do you prefer an automated system or a hands-on approach?

Expense Tracking: Look for tools that help categorize and track your spending.

Savings & Debt Payoff Features: Some planners help you set financial goals and track debt progress.

Ease of Use: The simpler the tool, the more likely you'll use it consistently.

Affordability: Budget planners range from free apps to premium subscriptions and high-end notebooks.

Compatibility: If choosing a digital planner, make sure it syncs with your bank or works on your device.

Here's a helpful tip: Find the one that closest fits your needs and tailor it to your own style

How to Choose the Right Budget Planner

After testing dozens of planners and helping friends find their perfect match, I've learned that choosing the right budget planner is highly personal.

Here's what I recommend considering:

First, be honest about your tracking style. Do you prefer the satisfaction of writing things down, or do you need the convenience of digital tracking? I've seen too many people buy beautiful paper planners only to have them gather dust because they really needed a digital solution.

Consider your financial goals. Are you focused on debt payoff, saving for a specific goal, or just trying to get a handle on daily expenses? Different planners excel at different aspects of financial planning. The best planner is the one that aligns with your primary financial goals.

Don't forget to factor in your schedule. Some planners require daily updating, while others work fine with weekly check-ins. Be realistic about how much time you can dedicate to tracking your finances.

Best Overall Budget Planner: The Clever Fox Budget Planner

What I particularly love about this planner is how it forces you to be mindful of your spending without feeling overwhelming. Each month starts with a budget planning section where you can set your income and expected expenses.

Then, there's plenty of space for daily tracking, which has honestly been eye-opening – who knew I was spending that much on coffee?

The planner comes with a hardcover design that's actually stood up to being tossed in my bag for months (trust me, I'm not exactly gentle with my belongings!).

The value it provides is outstanding. The pages include monthly budget spreads, daily expense tracking, and my favorite feature – the goal-setting section that helps you connect your daily spending decisions to your bigger financial dreams.

What really sets this planner apart is its perfect balance of comprehensive tracking and user-friendly design. When you first open it, you will immediately be impressed by the quality of the paper and the thoughtful layout.

It’s one of the best planners for serious long-term financial planning.

Clever Fox Budget Planner

Best for: Comprehensive monthly & yearly financial planning

Price: $15-$35

Features: Goal setting, debt payoff trackers, and monthly reviews

Best Digital Budget Planner: YNAB (You Need A Budget)

YNAB has completely transformed how people think about digital budgeting. The 2025 version includes several game-changing features that make it worth every penny of its $98.99 annual subscription.

Some may be skeptical about paying for a budgeting app at first (shouldn't saving money be free?), but the amount you can save using YNAB can more than pay for itself.

YNAB helps users get out of debt 4x faster than those who don’t budget, making it a great choice for serious money managers.

The latest version includes real-time synchronization across all devices, which means you can check your budget on my phone while standing in the store, contemplating that impulse purchase.

The app's new AI-powered spending insights feature is incredibly helpful – it learns patterns and gives you heads-up warnings when you're likely to overspend in certain categories. Pretty cool.

One feature I absolutely love is the loan planner tool, which helps you strategize debt payoff while maintaining your regular budget. It's like having a financial advisor in your pocket!

The learning curve can be a bit steep at first, but YNAB offers free workshops and an incredibly supportive community that makes the journey easier.

YNAB (You Need a Budget)

Best for: Zero-based budgeting & detailed financial control

Price: $14.99/month or $99/year (34-day free trial)

Platforms: iOS, Android, Web

Best Paper Budget Planner for Beginners: The Legend Budget Planner

When I first started budgeting, I was overwhelmed by complex systems and detailed tracking requirements. That's why I recommend the Legend Budget Planner for beginners.

Priced under $20 for the basic option, it offers the perfect introduction to budgeting without the intimidation factor of more complex planners.

The layout is incredibly intuitive, with step-by-step guides that walk you through the budgeting process. I appreciate how it starts with basic concepts and gradually introduces more advanced tracking methods.

The paper quality is excellent – no bleed-through even with gel pens – and the spiral binding lets the planner lay flat while you're writing. Those little things make a difference!

What makes this planner special is its "Budget Basics" section at the beginning, which explains financial concepts in plain English. It's like having a mini financial literacy course built right into your planner.

The monthly check-in pages also include encouraging prompts that help you reflect on your progress and adjust your goals as needed.

The Legend Budget Planner

Best for: Comprehensive monthly & yearly financial planning

Price: $15-$35

Features: Goal setting, debt payoff trackers, and monthly reviews

Best Luxury Budget Planner: Clever Fox Planner Pro Premium

If you're looking for a budget planner that doubles as a beautiful desk accessory, the Clever Fox Planner Pro Premium is worth the investment. It's definitely on the higher end, but the attention to detail and quality materials make it feel like a luxury item that motivates you to use it daily.

I was initially hesitant about spending this much on a budget planner, but the sophisticated design and durable construction have made it a joy to use.

The metallic accents and high-quality binding make it feel more like a premium journal than a utilitarian budget tool. The pages are thick enough to prevent any ink bleeding, and the colorful monthly dividers make it easy to stay organized.

What really impressed me was the thoughtful layout of the expense tracking pages. They include specialized sections for different spending categories, and there's even a pocket folder for storing receipts – a feature I didn't know I needed until I had it!

The monthly review sections include inspiring quotes and beautiful designs that actually make budgeting feel like a form of self-care.

The Clever Fox Planner Pro Premium

Best for: Portable and stylish budgeting

Price: $44

Features: Compact design, savings trackers, bill payment checklists

Best Cash Management: Clever Fox Cash Envelope System

Sometimes the best solution isn't choosing between digital and paper – it's getting down to the cold hard cash! I've found this particularly effective for visual learners who still appreciate the tactile experience of holding physical currency.

This perfect for those who love the cash envelope system. You manually allocate money into different categories (like food, rent, and savings) and track spending from there. It’s also great for couples who want to budget together.

I've found this process helps me be more mindful of my spending patterns.

What makes this system special is how it simplifies financial planning to it's most basic level. Create a budget and stuff the envelope for each category with cash. When the cash is gone you're done spending in that category. It's like having a budgeting tool and a financial coach in one package!

Clever Fox Cash Envelopes

Best for: Envelope budgeting system

Price: $20

Features: Colorful and easy to organize envelopes

Best Budget Planner Bundle: Passionate Penny Pincher Money Planner

When I was focused on paying off debt, I discovered that regular budget planners didn't quite cut it. The Passionate Penny Pincher Money Planner, however, is specifically designed with debt payoff in mind.

The debt tracking features are exceptional, with dedicated pages for listing all your debts and watching them shrink over time. The easy to understand layout has been particularly motivating – there's something incredibly satisfying about using this planner! The planner can be used with both snowball and avalanche debt payoff methods, allowing you to choose the strategy that works best for you.

What really sets this planner apart is its combination of worksheets and money envelopes. It's a package deal that helps to have all tools available to work towards your goals. Having everything in one place to manage your day to day expenses and pay off debt using this system are incredibly motivating during tough months.

Passionate Penny Pincher Money Planner

Best for: Expense management and debt payoff

Price: $54

Features: Monthly and annual worksheets and money envelopes

Best Minimalist Budget Planner: Erin Condren Budget Book

In a world of complex budgeting systems, sometimes less is more. This budget book lives up to its name with a clean, straightforward approach to budget tracking.

When my previous planner started feeling overwhelming, switching to this minimalist option actually helped me stick to my budget better.

The genius of this planner lies in its stripped-down approach. Each month gets a simple two-page spread with clearly defined sections for income, expenses, and savings goals.

There's no unnecessary fluff or complicated tracking systems – just the essential information you need to stay on top of your finances.

I particularly appreciate the planner's focus on intentional spending. Rather than tracking every penny, it encourages you to think about your priorities and align your spending with your values.

The weekly check-in pages help you stay accountable without feeling overwhelmed by details.

Erin Condren Budget Book

Best for: Expense management and debt payoff

Price: $10

Features: Monthly and annual worksheets and money envelopes

Best Free Budget Planner: Every Dollar

Let's be honest – not everyone wants to spend money to save money. That's where starting at Dave Ramsey's Every Dollar comes in, and I can tell you from experience that this feature shouldn't be underestimated.

While other free apps often feel limited, Every Dollar offers a surprisingly comprehensive set of features that rival many paid options.

The paid version includes several impressive updates, including improved bill tracking and a more intuitive interface. The automatic transaction categorization has become notably more accurate, which saves tons of time on manual corrections. I especially appreciate the new customizable alert system that notifies you about unusual spending patterns or when you're approaching budget limits.

What really impresses me about Every Dollar is its robust investment tracking features – something you rarely find in free apps. The ability to see all your accounts, including investments, credit cards, and loans, in one place gives you a complete picture of your financial health.

Every Dollar

Best for: zero-based budgeting

Price: Free or $120 annually for paid version

Features: Account aggregation and automated tracking

Most Customizable Planner: Zig Ziglar Performance Planner Plus

If you're anything like me, you might find that one-size-fits-all solutions don't always work for your unique financial situation. The Zig Ziglar Performance Planner Plus offers unparalleled customization options that let you create your perfect planning system.

This has been my go to planner over the last five years and I've become addicted at this point. It's a bit different in that it's not designed as a budget planner specifically but it's easily adaptable to be one.

I've found this flexibility invaluable as my needs have evolved throughout the years. You can start with the basic budget layouts and add specialized tracking pages for specific goals like vacation savings or home renovation funds.

What I particularly love is how you can keep track of all areas of life to create a comprehensive system. The leather cover is durable and gives it a classic heirloom quality that will last for years.

I'm much more likely to stick to my goals when I enjoy the process of maintaining it.

Zig Ziglar Performance Planner Plus

Best for: Comprehensive weekly, monthly & yearly financial planning

Price: $45

Features: Leather cover, goal setting, planning

Best DIY and Free: Simple Excel Budget Spreadsheet

Let me share why Excel spreadsheets are a game-changer for managing your money. Think of Excel as your financial command center – a place where you can see your entire money picture at a glance and make smarter decisions about your future.

When it comes to managing your money, Excel spreadsheets are one of the most powerful (and underrated) tools you can use. They offer a simple, customizable way to track your income, expenses, savings, and financial goals—all in one place.

Unlike budgeting apps that might limit your options or charge fees, Excel gives you total control over how you organize and analyze your finances.

With formulas and built-in functions, you can automate calculations, create visual charts to spot spending patterns, and set up templates tailored to your needs. Plus, it’s easy to adjust as your financial situation changes—whether you're tracking everyday expenses, planning for big purchases, or working toward debt freedom.

Best of all, Excel isn't just for finance wizards. If you can add and subtract, you can use Excel for budgeting. Start simple with basic income and expense tracking, then gradually explore more features as you get comfortable. Your spreadsheet can grow with you as your financial life becomes more complex.

Remember, the goal isn't to create the perfect spreadsheet – it's to build a tool that helps you feel more confident and in control of your money.

I've always used Excel in addition to other methods. It's simply a must for me at this point. Whether you're saving for a house, working to become debt-free, or just trying to spend more mindfully, Excel can help you turn those financial dreams into reality.

After months of testing and years of personal experience with different budget planners, I can confidently say that the right planning tool can dramatically impact your financial success.

Whether you choose the comprehensive features of the Clever Fox Budget Planner, the digital convenience of YNAB, or the free functionality of Excel, the most important thing is to start tracking your finances today.

Remember, the best budget planner is the one you'll actually use consistently.

Don't be afraid to try different options until you find your perfect match. Your future self will thank you for taking this step toward better financial health!

Have you used any of these budget planners?

I'd love to hear about your experiences in the comments below. And if you found this guide helpful, share it with someone who might benefit from better budget planning in 2025!

Member discussion